How Escrow Services Safeguard Online Transactions

Following the rise of fraudulent activities by scammers online, the need for innovative and secure ways to carryout transactions online have also experience a surge.

This article focuses on how you can use escrow services to safeguard your online transactions.

What is escrow and how does it work?

Definition of Escrow

Escrow can be defined as a financial agreement where an independent party often known as an escrow agent or an escrow service, holds assets or funds on behalf of two other parties involved in a transaction until both parties are satisfied.

An escrow agent or service’s sole purpose is to stand firmly between a buyer and seller, ensuring that both parties have arrived at the mutually agreed satisfaction point, where the buyer gets what they purchased, and the seller gets the money for their products.

Real-Life Example of an Escrow Transaction

A simple analogy is, imagine a situation where Biodun wants to buy a wig from Chineye whose wig advert, she had just seen on Instagram, but based on experience, she does not trust Chineye to deliver the wigs to her, at least, not in the quality she had seen and ordered it in. On the other end, Chineye does not trust Biodun well enough to let out such an expensive wig on the payment on delivery option as in the past, fraudulent customers have collected her wigs without paying afterwards.

To solve these issues, they both agree to give their items to a neutral lawyer who will hold Biodun’s money and Chineye’s wig until they confirm they are both satisfied with the exchange because both parties is now aware that each item is now with the lawyer who now goes ahead to release Biodun’s new wig to her, and the funds to Chineye.

Roles of the buyer, seller, and escrow service

The Buyer:

During the online transaction, the buyer is vested with the responsibility of depositing the seller’s money or any other required funds into the escrow account.

– The buyer secures financing, if necessary, and meet all contingencies outlined in the purchase agreement, such as inspection and due diligence.

– They sign loan documents and other necessary paperwork or forms as part of the escrow process.

The Seller:

– The seller must meet their obligations as per the agreement, such as ensuring the item, product or service is ready and in good conditions, as well as, fulfilling any other conditions specified by the escrow agent or the escrow contact.

– They must ensure that they provide all necessary documents and disclosure are provided to the escrow service or agent.

Escrow Service (Agent):

– The escrow agent must act in a neutral capacity while holding funds and important documents until conditions are met.

– They ensure that all conditions have been met and fulfilled by both parties, such as confirming the buyer’s funds have been received and that the seller’s product is on the way.

– The escrow agents coordinates and communication between the parties, verifies authenticity of documents, and manages the funds in escrow account.

– As soon as all conditions have been met, the escrow agent releases funds to the seller and other relevant documents and items to the appropriate parties, finalizing the transaction.

– The escrow agent has the capacity to settle dispute where necessary.

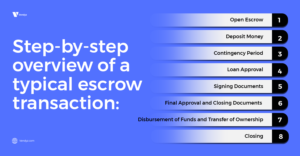

Step-by-step overview of a typical escrow transaction:

This is a typical overview of how escrow transaction take place. However, these steps might not apply in all contexts of buying and selling, and the digital world has produced diverse effective ways to make it as seamless as possible to carry out an escrow transaction.

- Open Escrow

- Deposit Money

- Contingency Period

- Loan Approval

- Signing Documents

- Final Approval and Closing Documents

- Disbursement of Funds and Transfer of Ownership

- Closing

1. Open Escrow:

This is the beginning stage which often comes after the buyer has made his or her research and chosen a seller they would like to buy from. Here the buyer and seller enter into a legal agreement to use an escrow service like Vendyz as the medium for their transaction.

2. Deposit Money:

The buyer deposits the funds into the escrow account to show their sincere interest about the purchase. The seller can confirm the payment has been made to the escrow service but cannot have access to this fund until the transaction is complete.

3. Contingency Period:

This stage is not constant in all purchase circle. However, it is most common in property acquisition purchase circle. Here, the buyer can inspect the property and perform due diligence on it and can choose to back out of the sales if they find any issues with the property that they are not willing to accept.

4. Loan Approval:

After the buyer have passed through the contingency period, there is a period allocated for loan approval in cases where the buyer us obtaining financing through loan. The typical timeline is somewhere around 30 days after the buyer’s offer is accepted. When this stage is completed, the escrow agent ensures the funding is secure before the next step takes place.

5. Signing Documents:

In this stage, the buyer and seller sign all the escrow instruction which contains an outline of the terms and conditions of the transactions. The buyer will also sign loan documents if financing is involved. The escrow agent then goes on to ensure that all documents are signed and notarized.

Final Approval and Closing Documents:

The escrow agent confirms that all the necessary documentation and requirements have been fulfilled. This includes ensuring fundings have been secured from the buyer as well as other obligations met.

7. Disbursement of funds and Transfer of Ownership:

Once all conditions are met, the escrow agent disburses the funds to the seller and ensures the property or product has successfully gotten to the buyer, and they are now in possession of it.

8. Closing:

The escrow agent confirms the completion of the transaction processes and takes accurate records of it for future references.

Benefits of escrow services for buyers and sellers:

There are several significant benefits that escrow services offer both buyers and sellers with the aim of mitigating risks and ensuring transparency, and fairness in transactions. Below are some benefits to consider:

Benefits for Buyers:

- Assurance of Payment Release

- Protection from Fraud and Disputes

- Transparency and Fairness

Assurance of Payment Release:

The benefit of escrow for buyer is that it provides assurance that their payment will only be released when they receive the agreed product from the seller. This protects the buyer from being a victim of “What you ordered vs what you get” situation or being blocked by a scam seller.

Protection from Fraud and Disputes:

Escrow services reduce the risk of fraud by holding the buyers fund till all the conditions have been met. If the seller does not fulfill their path of the transaction the escrow agent or service can refund the buyer’s money back, thereby, safeguarding their financial interest.

Transparency and Fairness:

Escrow services build the trust and confidence of the buyer during the transaction process by ensuring that the transaction is conducted transparently and fairly. This also goes a long mile in reducing the likelihood of misunderstanding or disputes.

Benefits for Sellers:

- Guarantee of payment

- Reduced Risk of Non-Payment

- Enhanced Trust and Credibility

Guarantee of payment:

One of the major benefits of escrow service is the assurance that they will be paid once they will be paid once, they fulfill their part of the transaction. The escrow service holds the payment until the seller delivers the goods or service as agreed.

Reduced Risk of Non-Payment:

With escrow services, sellers are often protected from the risk of not receiving payment or complete payment after delivering their goods or service to the buyer. They also get protected from the chances of receiving fake transfer when dealing with a fraudulent buyer.

Enhanced Trust and Credibility:

Using escrow can enhance the seller’s reputation by demonstrating a commitment to fairness and transparency. This can attract more buyer and build strong business relationships.

Real-life examples of situations where escrow services have protected buyers and sellers:

Escrow service can be applied in several real-life situations including the following:

Online Purchases

Business Transactions

Real Estate Transactions

Online Purchases:

For online transactions, especially for high-value items like electronics or jewelry, escrow services can protect both buyer and sellers. For Instance, if a buyer is purchasing an iPhone 16 pro-online, the escrow service holds his funds until the buyer receives and confirms the phone is in good condition and the sell has not sold to him a refurbished in disguise of a new one. If the phone was not delivered in the condition it was ordered in, the escrow agent can refund the buyer and ensure the device is returned to the seller.

Business Transactions:

In business deals, such as mergers and acquisitions of properties or large-scale purchases, escrow services can mitigate significant risk. For example, if a bank is acquiring another bank, the escrow service can hold payments until all due diligence is completed and regulatory approvals are obtained. This ensures that the buyer’s funds are secure until all conditions are met, and the seller is paid only after fulfilling their obligations.

Real Estate Transactions:

The real estate industry has been one of the earliest industries to adopt escrow services as a means of transacting with customers. In real estate transactions, escrow agents pay an important role ensuring that both buyers and the real estate companies meet their obligations during the transaction process. For example, if a buyer is purchasing a house, the escrow agent can facilitate negotiations or return the funds to the buyer if the conditions are not satisfied. This protects both parties by ensuring that the transaction proceed only if all terms are met.

The impact of escrow on reducing online fraud

Statistics on the Rise of Online Fraud:

In recent years, online fraud has seen a significant rise posing a huge threat to both buyers and sellers carrying out online transactions. According to the Punch Newspaper in publication titled “Unveiling the scam: How Nigerians fall victims to multi-million cyber fraud”, in 2024, so far, the estimated total loss Nigerian have experienced to fraud is approximately $10,038,817, with a significant portion of these losses attributed to online transactions.

How Escrow Service Combat Online Fraud

Escrow service play a crucial role in mitigating the risks commonly associated with online fraud by introducing a layer of security and transparency into transactions.

– Neutral Third Party

– Conditions-Based Release

– Detailed Record-Keeping

Neutral Third Party:

An escrow service stands as a neutral third party, holding funds or assets which can include property documents, products and services until all conditions of the transactions have been met. This goes a mile in ensuring that the buyer’s funds is secure and the sellers products or items are also secure and will only be released when there satisfaction on both end.

Conditions-Based Release:

The escrow agent has the power to release funds only after verifying that all agreed-upon conditions has been met, therefore reducing the risk of payments being made for undelivered or unsatisfactory goods, or no payment after receiving goods.

Detailed Record-Keeping:

The escrow agents keep detailed record of the transaction for reference purposes. This way, if ever dispute arise, this record can help resolve them.

Escrow vs Traditional Transaction Methods

Digital Bank Transfers:

- Lack of Intermediary: In direct bank transfer, funds are transferred directly from the buyer to the seller without any intermediary, leaving the buyer at the risk of being defrauded by a scam seller. Although banks have added features to report fraudulent transactions, this process has in most case proven to be unsuccess with an endless and constant email exchange between the buyer and their bank.

- Immediate Transfer: Direct bank transfers, especially wire transfer, are often immediate and irrevocable, which means there is a significant risk for the buyer if the seller does not deliver the goods or service as agreed.

Credit Card Transaction:

- Chargeback Protection: Credit cards offers users some level of protection through its chargeback system, however, these can be overwhelming and may not always result to the buyer recovering their funds. Additionally, credit card companies often charge high fees to transactions, leading to extra cost for the buyer or seller.

- Limited Security: In some cases, credit cards do not provide the same level of security an escrow service can provide, as the payment s released immediately to a seller, leaving the buyer vulnerable if the goods or service are not delivered as agreed.

Escrow Service:

- Enhanced Security: Escrow service offers an enhanced layer of security by holding the buyer’s funds until they can confirm that what they ordered for is exactly what they got. It also ensures the seller’s payment has been received before their goods is let out to the customer. This ensures that the buyer and the seller are protected in the transaction process.

- Transparency and Fairness: Escrow services ensures that there is 100 percent transparency and fairness during the online transaction. They ensure that the buyer and seller are treated fairly with no party being able to manipulate the transaction process for their advantage.

- Regulatory Compliance: Escrow services and agents that are reputable, are governed by regulations that are regularly audited to ensure best practices and safety online, building a strong security and trust for the transaction process.

Conclusion:

Escrow services significantly reduce the risk of online fraud by providing a secure, transparent, and fair transaction process. By holding funds until all conditions are met and maintaining detailed records, escrow services offer a level of protection that traditional transaction methods cannot match.

[…] services can safeguard transactions by holding funds until both parties fulfill their obligations (Learn more about escrow services). This method adds an extra layer of trust between buyers and sellers in any transaction […]